“Change is brought about by people like us! We all have a voice, and what matters is how we use it and that we do use it.”

Aisha Oyebode

(CEO, Murtala Muhammed Foundation)

Dear {{First name|Active Citizen}},

So… who is actually taxable, and where does the tax apply?

After last week’s newsletter, many of you wrote in with this question. That tells us something important: there is genuine confusion about Nigeria’s new tax reform, not because people aren’t paying attention, but because the changes haven’t been clearly explained.

So let’s slow this down and walk through it properly.

Who does the law say should pay tax?

Under the tax reform laws passed in 2025, particularly the Nigeria Tax Administration Act, 2025, anyone who earns income is recognised as a taxable person. In simple terms: if you make money from work or business, the tax system now clearly counts you as visible.

If you earn a regular salary, nothing fundamental has changed. You were taxable before, and you’re still taxable now. Personal Income Tax, governed by the Personal Income Tax Act (PITA), continues to apply and is usually deducted through PAYE.

If you earn money as a freelancer, consultant, vendor, trader, artisan, content creator, or small business owner, the law now explicitly places you within the tax system, even if your work is informal or online. This does not automatically mean higher taxes, but it does mean the government expects registration and income declaration.

For companies, the distinction matters. Under the Companies Income Tax Act (CITA), small companies based on turnover and assets remain exempt from certain corporate taxes. But exemption does not mean exclusion. These businesses are still expected to exist within the tax system.

Where does the tax apply?

The new framework focuses on two things: where you live and where your income comes from.

If Nigeria is your main home, you live here, work here, or spend most of the year here, the law treats you as a tax resident. As a tax resident, income earned in Nigeria is taxable, and income earned outside Nigeria may also be taxable. This includes income from foreign clients and is one of the most debated aspects of the reform.

If you live outside Nigeria but earn income from Nigeria, for example, by running a business here or providing services to Nigerian companies, that Nigerian-sourced income is taxable.

One important clarification that keeps coming up: your bank balance is not taxed. Tax applies to income, not to money already sitting in your account.

Why this feels different and why people are worried

A big part of the anxiety is timing and communication. Before now, Nigeria’s tax system operated through several separate laws, including PITA, CITA, the Value Added Tax Act, and the Capital Gains Tax Act. These laws often worked in silos, leaving grey areas around digital income, informal work, and residency. Enforcement was also inconsistent.

The 2025 reforms introduced overarching laws, including the Nigeria Tax Act, 2025 and the Nigeria Tax Administration Act, 2025, to bring these rules under a more unified structure. In practice, this means more people are clearly captured as taxable, especially those previously operating in grey zones.

The problem is that this consolidation happened without adequate public education. Definitions remain unclear for many freelancers and informal workers. People are being told to comply without clear guidance on how. And all of this is happening in a context where trust is already low, because improved public services and transparency have not kept pace with revenue demands.

So what should citizens do now?

If you earn income, assume the tax system is paying closer attention. Keep records, ask questions, and don’t rely on rumours or social media explanations.

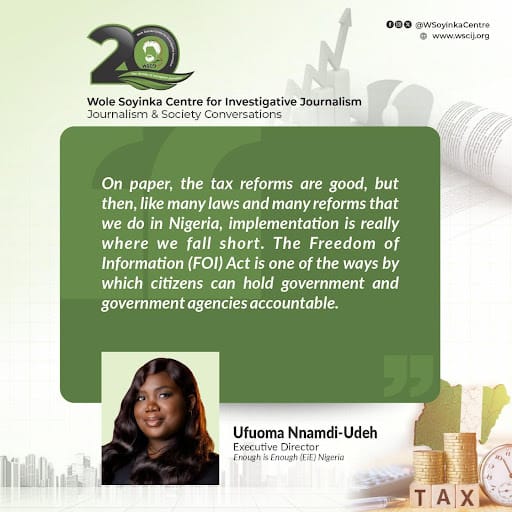

Citizens can also demand better communication from tax authorities, ask elected representatives for explanations of laws passed in their name, and use tools such as FOI requests to understand how tax revenue is used and how enforcement decisions are made.

Understanding the tax system does not mean defending it. It means knowing enough to protect yourself and to ask better questions of those in power.

We were part of a conversation discussing the tax laws this week, you can listen to the X space recording here.

In the next issue, we’ll take this further by looking at what tax compliance actually means in practice, especially for salary earners, freelancers, small businesses, and informal workers.

If there are questions you’re still sitting with, or situations you want clarity on, reply to this email and tell us. Your responses will shape what we break down next.

You Can Still Pre-Order!

Footprints 2.0 Past. Present. Future. is a commemorative publication marking EiE Nigeria’s 15 years of driving active citizenship and democratic accountability in Nigeria.

Have a great weekend!

The EiE Nigeria Team.